Related Posts

It's no secret that the U.S. is struggling with an historic housing shortage compounded by rising rents. One meaningful - and increasingly popular - path to helping financially-strapped renters, homeowners, and businesses is through community solar programs. Unlike single family homes where rooftop solar is more feasible and financially beneficial to the homeowner, renters don't have the option of exploring [...]

We're excited to announce that Pasture Voltaics LLC and its unique SunTracker technology have joined the PlanitWorks partner family. Using raised, high-tensile cables positioned nine feet above the ground to control a solar grid array to track the sun, SunTracker enables ranchers, farmers, Native American tribes, and other entities with vested land management interests to: Provide green energy development Protect [...]

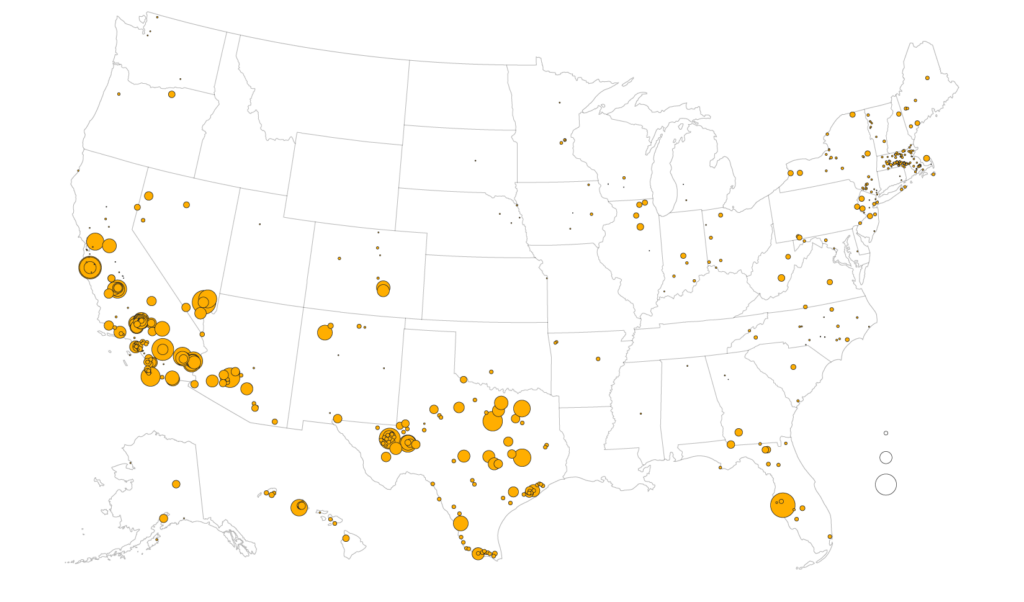

Federal hurdles, including onerous fees and development delays, are seriously hampering tribal nations' efforts to implement ambitious alternative energy projects that could generate reliable power, new jobs, clean energy, and massive new economic opportunities. Although the Inflation Reduction Act (IRA) committed hundreds of billions to support clean energy initiatives across the country, a perfect storm of interconnection requirements, a high [...]